Business inventories in economics represent a fundamental aspect of both business operations and macroeconomic health, setting the stage for understanding how companies function and economies evolve. From the factory floor to the retail shelf, inventories are a silent indicator of production efficiency, consumer demand, and market stability.

This topic delves into the definition, types, and measurement of business inventories, illuminating their critical role in shaping economic cycles. By exploring inventory management strategies, government data sources, and modern technological advancements, we uncover the dynamic interplay between inventory levels, business decisions, and broader economic trends.

Definition and Importance of Business Inventories in Economics

Business inventories in economics refer to the goods and materials that businesses hold in stock to support production, meet customer demand, and smooth out fluctuations in supply and sales. These inventories encompass everything from raw materials waiting to be turned into products, to finished goods ready for sale. Inventories are a crucial part of a company’s operational cycle, directly impacting production efficiency, customer satisfaction, and overall profitability.

On a broader scale, inventories play a key role in the functioning of the entire economy. They act as buffers that help manage the mismatch between production and consumption. Changes in inventory levels provide important clues about business expectations, supply chain health, and the direction of economic growth. When businesses accumulate inventories, it may signal optimism about future sales or slower than expected demand. Conversely, rapid inventory depletion can indicate strong sales or concerns about overstocking.

Inventory fluctuations can amplify economic cycles: rising inventories may foreshadow slowdowns as supply outpaces demand, while falling inventories often signal robust sales and production growth, influencing GDP and business investment decisions.

Components and Types of Business Inventories

Business inventories are typically divided into several core categories, each fulfilling specific roles in production and distribution. The three primary types are raw materials, work-in-progress (WIP), and finished goods. Understanding these components allows companies to manage their supply chains more effectively and respond to shifts in demand or supply disruptions.

| Inventory Type | Characteristics | Typical Industries | Storage Requirements |

|---|---|---|---|

| Raw Materials | Unprocessed items used in manufacturing | Automotive, Textiles, Electronics | Climate control, secure warehousing |

| Work-in-Progress (WIP) | Partially finished goods mid-production | Manufacturing, Construction | Accessible, organized tracking |

| Finished Goods | Ready-for-sale products | Retail, Wholesale, Distribution | Display-ready, inventory control systems |

| Merchandise | Goods bought for resale without alteration | Retail, E-commerce | Shelving, barcode management |

Merchandise inventories are typical for retailers and wholesalers, encompassing products purchased for direct resale. Manufacturing inventories include all three primary types—raw materials, WIP, and finished goods—reflecting the stages of the production process. Retail inventories, on the other hand, usually consist only of finished goods stocked for sale to consumers. Each type has unique management and storage considerations based on the business model and industry practices.

Measurement and Reporting of Inventories

![]()

Accurate measurement and reporting of inventories are fundamental for reliable financial statements and effective business management. Accounting standards offer several methods for valuing and tracking inventory, each with distinct implications for profit reporting and taxation.

Inventory Valuation Methods, Business inventories in economics

The main methods for measuring business inventories are:

- First-In, First-Out (FIFO): Assumes the earliest goods purchased are the first sold.

- Last-In, First-Out (LIFO): Assumes the latest items purchased are sold first, often used to minimize taxable income during inflation.

- Weighted Average Cost: Calculates inventory value based on the average cost of all units available during the period.

Procedures for Recording and Reporting Inventories

![]()

Businesses follow a consistent process to account for inventories in their financial records. These steps ensure that inventory values are accurately reflected and comply with accounting standards.

- Conduct physical counts of inventory at regular intervals.

- Apply the chosen inventory valuation method (FIFO, LIFO, or weighted average).

- Adjust for shrinkage, obsolescence, or damage.

- Report inventory values in the balance sheet as current assets.

- Include inventory changes in the calculation of Cost of Goods Sold (COGS) in the income statement.

Inventory valuation is crucial for both business accounting and economic statistics. It directly affects reported profits, tax liabilities, and the assessment of a firm’s financial health. On a macroeconomic level, aggregate inventory data feeds into GDP calculations, providing insights into economic momentum and potential turning points.

The Role of Business Inventories in Economic Cycles

Inventory levels often shift in response to changes in economic conditions, and these shifts can act as leading or lagging indicators of broader business cycles. Rising inventories may indicate that demand is softening or that firms expect future sales to increase, while falling inventories usually reflect strong sales or concerns about potential slowdowns.

| Phase | Inventory Trend | Economic Activity | Implications |

|---|---|---|---|

| Expansion | Inventories increase moderately | Production and sales rise | Optimism, restocking in anticipation of demand |

| Peak | Inventories accumulate rapidly | Production outpaces sales | Potential warning of slowdown or overconfidence |

| Contraction | Inventories decline or are liquidated | Production slows, sales fall | Firms cut back, signaling downturn |

| Trough | Low or stable inventories | Production and sales stabilize | Base for next expansion phase |

Historically, abrupt swings in inventory levels have amplified recessions and recoveries. For example, during the 2008 global financial crisis, sudden declines in demand led to massive inventory liquidations, deepening the downturn. In contrast, post-recession recoveries often feature rapid restocking, which propels GDP growth as businesses ramp up production to rebuild depleted inventories.

Inventory Management Strategies

![]()

Effective inventory management is essential for minimizing costs, meeting customer expectations, and responding agilely to market changes. Businesses employ various strategies to balance these objectives and reduce risks associated with holding or running out of stock.

- Just-In-Time (JIT): Minimizes inventory holding by aligning deliveries closely with production schedules, reducing storage costs and waste.

- Economic Order Quantity (EOQ): Calculates the optimal order size that minimizes total inventory costs, considering ordering and holding expenses.

- Safety Stock: Maintains extra inventory as a buffer against unpredictable demand or supply disruptions, ensuring service continuity.

Well-executed inventory management improves cash flow, increases operational efficiency, and enhances customer satisfaction. However, over-optimization can expose firms to risks such as stockouts during supply chain disruptions or excess costs from overstocking.

Traditional inventory control relies on manual tracking, periodic stocktaking, and basic reorder point systems. In comparison, modern approaches leverage real-time data, automated reordering, and advanced analytics to forecast demand and optimize stock levels. These technology-driven methods offer greater accuracy and responsiveness, especially in fast-moving or complex supply chains.

Government Data and Economic Indicators Related to Inventories

Government agencies regularly collect and publish detailed statistics on business inventories, which serve as key economic indicators for analysts and policymakers. These data highlight trends in production, distribution, and overall business sentiment.

- U.S. Census Bureau: Publishes the Monthly Wholesale Trade Survey and Manufacturers’ Shipments, Inventories, and Orders (M3) Report.

- Bureau of Economic Analysis (BEA): Incorporates inventory data into GDP calculations and economic analysis.

- Eurostat: Releases inventory statistics for EU member states, aiding in cross-country comparisons.

- National statistical offices: Provide industry-specific and national inventory series worldwide.

| Indicator | Data Frequency | Coverage | Reporting Agency |

|---|---|---|---|

| Business Inventories | Monthly | Wholesale, Retail, Manufacturing | U.S. Census Bureau |

| Inventory-to-Sales Ratio | Monthly | All industries | U.S. Census Bureau |

| Manufacturers’ Inventories | Monthly | Manufacturing sector | U.S. Census Bureau |

| GDP Inventory Change | Quarterly | National economy | BEA, Eurostat |

Inventory data are integral to economic forecasting and policy formulation. Policymakers use these statistics to assess supply chain health, detect early signs of economic turning points, and design targeted interventions to stabilize markets or stimulate growth.

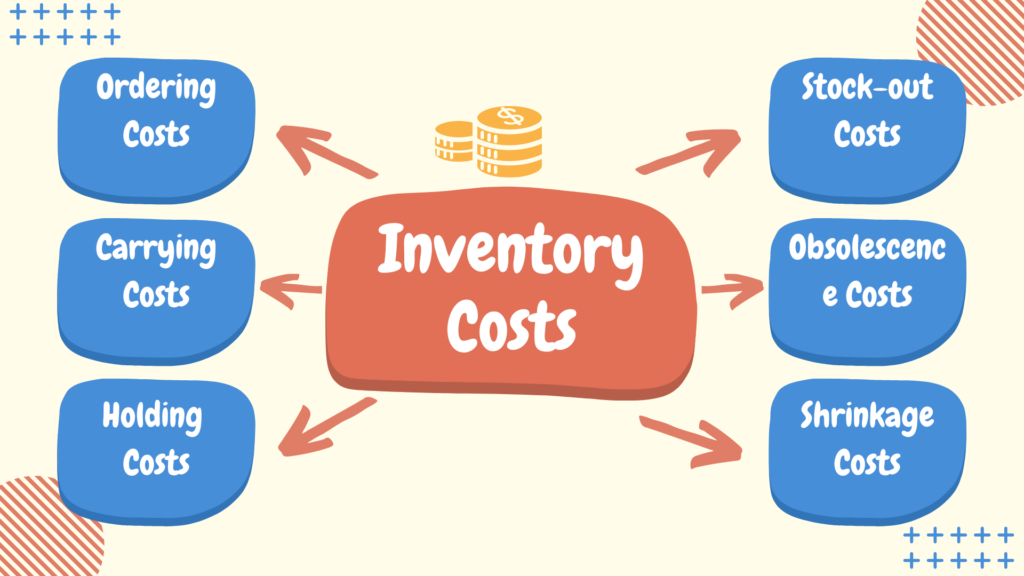

Challenges and Risks in Inventory Management

Managing inventories is fraught with challenges, as businesses must navigate uncertain demand, fluctuating supply, and operational complexities. Mismanagement can lead to significant financial and reputational risks.

Some of the most common risks associated with overstocking and understocking include:

- Tied-up capital resulting in cash flow constraints

- Obsolescence and spoilage of unsold goods

- Increased storage and insurance costs

- Lost sales and dissatisfied customers due to stockouts

- Production delays from insufficient materials

To mitigate these risks, companies implement strategies such as demand forecasting, flexible supplier agreements, dynamic safety stock policies, and supply chain diversification. Advanced analytics and scenario planning also help businesses prepare for sudden disruptions, improving resilience and agility in uncertain environments.

Technological Innovations in Inventory Management: Business Inventories In Economics

The rise of new technologies has dramatically transformed inventory management across industries. Innovations like RFID (Radio Frequency Identification), automation, and artificial intelligence (AI) enable companies to track goods in real time, optimize stock levels, and respond swiftly to market changes.

| Technology | Application | Benefits | Industry Adoption Examples |

|---|---|---|---|

| RFID | Real-time inventory tracking | Reduces shrinkage, improves accuracy | Retail, Logistics, Healthcare |

| Automation | Warehouse robotics, automated picking | Boosts efficiency, lowers labor costs | E-commerce, Warehousing |

| AI & Machine Learning | Demand forecasting, stock optimization | Improves predictions, minimizes stockouts | Manufacturing, Grocery, Fast Fashion |

| Cloud Inventory Systems | Centralized, accessible inventory data | Enhances collaboration, supports scalability | Small Business, Global Supply Chains |

Digital transformation is reshaping inventory practices by integrating real-time data, predictive analytics, and connected devices. These advances enable companies to anticipate disruptions, streamline operations, and maintain competitive advantage in rapidly changing markets.

Last Point

In summary, business inventories in economics serve as a vital barometer for both individual companies and the economy as a whole. By managing inventories effectively and leveraging technological innovations, businesses not only improve their operational efficiency but also provide policymakers and analysts with valuable data to anticipate economic shifts. Staying informed about inventory trends and practices is essential for navigating an ever-changing economic landscape.

Helpful Answers

What are business inventories in economics?

Business inventories in economics refer to the goods and materials that companies keep on hand to support production, sales, and distribution processes. They are considered current assets and include raw materials, work-in-progress items, and finished goods.

How do business inventories affect the economy?

Changes in business inventories can signal shifts in demand and production. Rising inventories may indicate slowing sales, while falling inventories may suggest increased consumer demand. These trends influence GDP calculations and economic policy decisions.

Why is inventory management important for businesses?

Effective inventory management helps companies balance having enough stock to meet customer demand without tying up excessive capital. It reduces costs, prevents overstocking or stockouts, and improves overall operational efficiency.

What are the risks of poor inventory control?

Poor inventory control can lead to overstocking, tying up cash and increasing storage costs, or understocking, causing missed sales and dissatisfied customers. Both scenarios negatively impact profitability and competitiveness.

How does technology improve inventory management?

Technologies like RFID, automation, and artificial intelligence enable real-time tracking, accurate forecasting, and optimized inventory levels, reducing errors and supporting smarter business decisions.